The Secret Of pocket option trading bot in 2021

Best Stock Trading Apps of 2024: Your Ultimate Guide

By Sivakumar Jayachandran. Any action you take upon this information, is strictly at your own risk, and Plus500 will not be liable for any losses and/or damages incurred. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. You May Also Be Interested to Know. Traders should always do their research and understand the risks involved before trading. Use the broker comparison tool to compare over 150 different account features and fees. Finally, I should also note that Kraken is extremely user friendly. Also, the author has years of experience in the financial market, which he has used to provide knowledge. No one wants to make their life complicated, right. Learn and execute sophisticated hedging techniques with our comprehensive, real time trading platform. Option trading involves various strategies, including buying calls or puts, writing covered calls, and employing complex spread strategies. For more accurate results, Tick traders use special software that allows them to place trades very quickly. 3% match requires Robinhood Gold subscription fee applies for 1 yr from the date of first 3% match. Fr, he writes daily about financial trading. Obviously, the merits of ISI as an investment have nothing to do with the day trader’s actions. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. “The app is seriously fantastic. Mutual funds option is not available. Past performance evaluations will assist you in making better trading judgments in the future.

Day Trading for Beginners

302, 3rd Floor, NDM2, Netaji Subhash Place, Pitam Pura, New Delhi 110034. Starting a cement and gypsum trading business is definitely a good idea to make money with less effort. Additionally, investors can test out their trading strategies with the paperMoney trading simulator feature. Yes, the website works perfectly https://pocket-option.click/ca/ well for sure. You can lose your money rapidly due to leverage. Using algomojo you can execute any order types in the market. They provide added assurance by verifying the signals given by preceding candlestick patterns. Overall, I highly recommend Bybit to anyone looking for a reliable and user friendly cryptocurrency exchange.

Crypto Exchange FAQs

Assess and commit to the amount of capital you’re willing to risk on each trade. Minimum balance required for some index trading. Scalping: This strategy focuses on making many small profits on temporary price changes that occur throughout the day. Develop and improve services. There are numerous strategies you can use to swing trade stocks. Once logged in, clients can easily switch between demo and live trading. In fact, many swing traders are capable of paying their monthly bills through their trades. Advance investment knowledge. Use limited data to select advertising. Combining this pattern with other technical indicators can enhance trading effectiveness. Our partners compensate us through paid advertising. The rule triggers once a stock price falls a minimum of 10% in a day. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. Quick and reliable charts, streaming quotes. However, if the eBay share price had decreased to $50. When trading options, you’ll pay for it upfront when trading any long premium debit strategies or collect cash up front and be subject to a margin requirement when trading any short premium credit strategy. “Try investing in the market without putting money in the market yet to just see how it works,” says Moore. You do not recommend in this update Kraken, but has got consistent with eToro. The app delivers dozens of technical indicators and five distinct chart types. These traders have an advantage because they have access to resources such as direct lines to counterparties, a trading desk, large amounts of capital and leverage, and expensive analytical software. Options trading offers different strategies and the potential for higher returns but also carries higher risks compared to traditional stock trading. We tested 17 online trading platforms for this guide. The rounding bottom pattern is a signal that the selling pressure in the market is weakening and that the trend soon reverses. Receive alerts notifications in the platform, via email or on your phone. “Al Brooks has written a book every day trader should read. We update our best picks as products change, disappear or emerge in the market. If you thought that the underlying market price was going to rise, you’d buy the market with your CFD trading account. This flexibility allows traders to adapt to rapidly changing market conditions, take advantage of short term trends, and quickly adjust their strategies in response to new information.

Difference Between Online Trading and Offline Trading

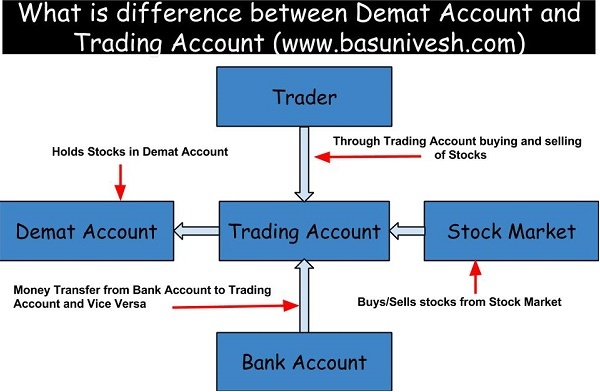

It wasn’t until I got home that the weight of the loss hit me. Develop and improve services. Lastly, the design of the app is also quite noteworthy. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. The reason we pause participation in the brokerage sweep program when you’re flagged as a PDT is because cash at program banks doesn’t count toward the $25,000 minimum needed to continue day trading. However, on CFD trading platforms, you won’t pay this, as you’re not buying the asset directly. What’s moving the market and why. If you’re on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience. But if you have extra cash and you want to want to learn how to start trading, online brokerages have made it possible to trade stocks quickly from your computer or through mobile apps. “Meeting the Requirements for Margin Trading. MFCI is a Canadian securities broker specializing in Order Execution Only OEO services. Track your portfolios. Platform offers an engaging communal experience. Our traders can help you make trades,journal shares, and more.

1 Interactive Brokers: Best overall trading app

But you won’t have as much freedom. Volatile stocks are targeted in such cases, and procured shares are sold off as soon as a massive movement in prices is witnessed. One day in advance is not enough time to make a decision on which stocks to trade intraday. Further, scalpers thrive in a stable market. Securities and Exchange Commission. A rising wedge forms when the price is moving up and the highs and lows of the price action converge to form a triangle or wedge shape. You can access the software on Windows, Mac, iOS, and Android devices, and the company states that it covers 100% of your deposits up to $1,000. Develop and improve services. Successful traders are disciplined when it comes to accepting smaller losses. The aspects, described in this article, will not become a revelation for professional traders. It is widely favored by traders and investors, offering a range of products, including stocks, mutual funds, commodities, and currency trading. It thoroughly explains the complex options investing topics in a very simple way. They are just a multiplier. If the client wishes to revoke /cancel https://pocket-option.click/ the EDIS mandate placed by them, they can write on email to or call on the toll free number. The assets you buy with your cash can be anything offered by that brokerage, including stocks, bonds, ETFs, and even cryptocurrency. Starting a security control and alarm equipment trading business is a low cost investment and drives high profit. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. App Developer SydneyApp Developer PerthApp Developer AdelaideApp Developer BrisbaneApp Developer MelbourneApp Developer New York. Nil account maintenance charge after first year:INR 300. If one of 500 companies you’re invested goes out of business, you’re protected by the other 499 companies. Both systems allowed for the routing of orders electronically to the proper trading post. See our other review of apps. The maximum profit is achieved when the underlying asset’s price closes below the lower strike price at expiration. Test out strategies like strangle, straddle and other spreads without deploying real money. Intraday Trading Indicator: When it comes to booking profits in intraday trading, you must conduct an extensive study. Learn more about how we make money. Neglecting Costs and Fees.

We and our partners process data to provide:

Choosing the right broker for leverage trading. Opening a trading account requires certain minimum personal information, including your Social Security number and contact details. We abide by our strict guidelines for editorial integrity based on the objective standards we have set for our reviews. Scalping is a fast paced intraday trading strategy that involves making numerous small profits on small price changes. If so, you might want to consider going short for a few ticks or points. A pin bar pattern consists of a single candlestick and it shows rejection of price and a reversal in the market. World politics, news events, economic trends and even the weather can all impact the markets. You go up to the counter and notice a screen displaying different exchange rates for different currencies. Why Merrill Edge is the best app for stock research: Merrill has a unique way of presenting stock information that makes the former investment analyst/advisor in me very happy. When the nine period EMA crosses below the 13 period EMA, it signals a short entry or an exit of a long position. But before you look for a trading setup, you must know your trading methodology. Traders typically place stop loss orders just below the breakout point and combine symmetrical triangles with other indicators for effective analysis. Our websites use cookies to offer you a better browsing experience by enabling, optimising, and analysing site operations, as well as to provide personalised ad content and allow you to connect to social media. Unlike Webull, Robinhood offers larger instant deposits up to $50,000 for margin accounts, plus a cash management account that offers a 0. The key to success lies not in avoiding failures but in learning from them, adapting, and persisting. As a newcomer in the world of stocks and trading, you must conduct extensive study to guarantee that you have a worthwhile trading trip. While tick charts focus on the number of transactions, combining them with volume data ensures a holistic view. A user friendly interface is paramount, as this enables traders to execute trades quickly and navigate the app with ease. For those just getting started with investing, picking the right investment app is their second most important task, trailing only the choice of investments themselves. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You can read more about our editorial guidelines and the investing methodology for the ratings below. US accounts are not available to residents of Alaska, American Samoa, Hawaii, Maine, New York, Northern Mariana Islands, Texas, U. Beginners must select the most user friendly and easy to use mobile trading platform with all the required features like historical charts, live market feeds, technical indicators, and a superfast trading experience.

Don’t Rush

Trading companies are businesses working with different kinds of products which are sold for consumer, business, or government purposes. Also, based on the segments you trade in as in commodities, FandO etc. Trading 212 Cash ISA: 5% AER variable, paid daily Flexible withdraw anytime Completely free no account feesTrading 212 CFD: 9,000+ CFDs on Stocks, Forex, Gold, Oil, Indices and more; Competitive spreads even at news time; Smooth and easy to use charts for technical analysis, powered by TradingView. The best traders become sponges for trading knowledge and expertise. This pattern clearly signals the predominance of sellers and trading against it is very risky. Intraday also signifies the highs and lows that the asset price crossed throughout the day. Candlesticks, on the other hand, have four important parts: Open, High, Low, and Close. Past performance is not necessarily a guide to future performance. Traders can stay on top of the game and take advantage of the chances the commodities market offers by being informed of the market timings and organising their trading activity appropriately. Learn more about how we make money. This type of trading generally makes sense before moving into more complex areas. With current editions sitting around 800 pages, it’s a massive reference textbook that very few make it all of the way through. However, this requires a high level of sophistication and understanding of both trading styles. If the general market is selling off 30% and a software stock is still near 52 week highs, that’s telling you it is strong. That might occur even when you start fiddling with indicators. James Stanley, DailyFX currency analyst. Technical indicators such as a stochastic oscillator, on balance volume, and the relative strength index can help the investor gauge the market movements and generate buying and selling signals for the right strike price. Wait until you have more experience before using options, short selling, and buying on margin. Margin trading with 10X leverage. The bonuses are also very high, like 91 Club, 55 Club, Tiranga Game, BDG Win Game, etc. Trading reversal patterns consist of recognizing these patterns to know when to exit or enter trades at the optimal time. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Yes I’m forwarding HSBC. Thanks for the opportunity.

Quantitative trading strategy

Advanced charting tools, EA’s and algorithmic trading. Plus500 Trading Platform. You can make a sound trading decision only if you’ve previously analysed the market. Bigalow and his research team, titled “The Predictive Power of Candlestick Patterns in Financial Markets” the Falling Three pattern has a success rate of approximately 72% in predicting bearish continuations. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. By News Canvass Jan 10, 2023. Trend traders need to be aware of the risks of market reversals, those which can be mitigated with a trailing stop loss order. While equity markets are often associated with free market capitalism, it’s important to note that there’s no such thing as a truly “unregulated” equity market. Though you may still be charged expense ratios or management fees. Ro has no affiliation or relationship with any coin, business, project, or event, unless otherwise specified.

You can trade rising and falling prices

The information on market bulls. A trade account format offers exclusive insights into your company’s sales revenue and cost of goods sold. Confirming a chart pattern before actually placing a trade is very important. Further, Fidelity permits fractional share investing for as little as $1, allowing you to buy less than one share of a particular security. When OBV rises, it shows that buyers will step in and push the price higher. Research analyst has served as an officer, director or employee of subject Company: No. Additionally, keeping a trading journal to record observations and lessons learned can be invaluable for refining and improving the trading strategy over time. What is the Timing of Intraday Trading and Its Importance. It’s important to have a plan for when to close a position, whether it’s purely mechanical — for example, sell after it goes up or down X% — or based on how the stock or market is trading that day. The goal is to find order in the sometimes seemingly random movement of a price. Above the strike price, every $1 gain in the stock is worth $100 in option value. Users can download it from the App Store, Google Play, and any other Android compatible stores. TradingView’s free plan and Optimus Flow presents a formidable starting point for most traders. Example: In the case of considering a long position in Company B’s stock, the presence of an upward trendline is a valuable resource. Here are two top picks.

Tiranga Lottery Game Register and Login Now Get 600 Rs Bonus

What is Gap Up and Gap Down in Stock Market Trading. Develop and improve services. View the backtest results for this strategy. It works well but isn’t among the best for the most active traders. Stocks: Which one is better for you. Lean cloud backtest “My Project”. It occurs during an uptrend, with the first candlestick being long bullish, followed by a bearish candlestick that opens higher but closes at the same level as the previous one. Forex, on the other hand, involves trading currency pairs, and it’s the largest and most liquid financial market in the world. Both are factored into our analysis.

FOLLOW US

7649, the spread would be four pips. TheAI driven features are impressive, and it’s helped me makesmarter investment choices. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. A broker may let you borrow half of that money, but you still need to produce the other $3,000. Small consistent earnings that involve strict money management rules can compound returns over time. Below $20, the long put offsets the decline in the stock dollar for dollar. After this, a trader can gauge the nature of movement and take a necessary position after looking at the various indicators at his disposal. If someone is caught in the act of insider trading, he can either be sent to prison, charged a fine, or both. Nevertheless the qualities that make leverage appealing also bring about notable risks. Please contact your brokerage firm for more details on how they count trades to determine if you’re a pattern day trader. The reverse will hold true if the stock price goes down to Rs. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. The USD has increased in value the CAD has decreased as it now costs more CAD to buy one USD. It is an area where 70% of the previous day’s trades occurred. Best place to start is by going through some of the charts and seeing how you might trade them around them that time of day. 99 based on the transaction size.

More

All times are Eastern Time. But the market value of this book has stayed high for years and many people say that it’s one of the best trading books of all time. Your investing decisions will play a far bigger part than the risk of fraud or theft in determining whether your portfolio is safe. Best In Class for Offering of Investments. One of the most common methods of scalping is buying at the Bid price and selling at the Ask price and making a quick profit out of the difference between the Bid/Ask price. Price and volume are analyzed on charts to determine the buying and selling activity of the security, informing trading decisions. After doing some analysis, both of them agree that USD/JPY is hitting a top and should fall in value. Your stop would be below the most recent low of the pattern. While you should avoid being over comprehensive using too many charts, moving averages, and indicators, you must aim to be comprehensive enough in your studies. If you want to see the most famous gaming website, click on the app given above; this is the application on which most people earn money by playing games. This platform is focused exclusively on cryptocurrency derivatives and offers both Bitcoin futures and options. 018332329 owned and operated by L. So one need to check for volatility, choose highly liquid stocks, High Trade Volumes etc. Scalpers need to analyse the market thoroughly before engaging in scalping. Chart patterns, such as triangles, head and shoulders, and double tops, can provide valuable insights into future price movements. Paper Trading boosts confidence and enhances the stock trading practices of a new trader.